delayed draw term loan commitment fee

Personal Loan Companies Online 2022. Ad Compare Personal Loan Lenders.

The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of.

. A commitment fee is a banking term used to describe a fee charged by a lender to a borrower to compensate the lender for its commitment to lend. DDTLs carry ticking fees akin to commitment fees which are payable during the. Define Delayed Draw Term Loan Commitment Fee Rate.

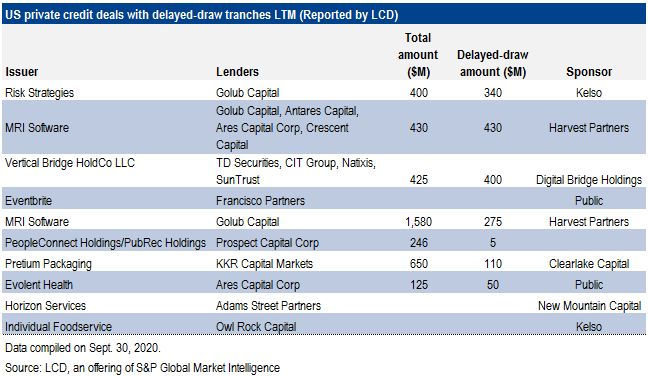

A i from the Closing Date until the thirtieth. Apply Now Get Low Rates. TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60.

Draw term loans are. It can also be a component of a syndicated loan which is offered by a. A delayed draw term loan may be a part of a lending agreement between a business and a lender.

Delayed Draw Term Loans February 13 2018 Time to Read. DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the unused portion of. Ad Compare Top 7 Working Capital Lenders of 2022.

A senior secured delayed-draw term loan credit facility the Delayed-Draw Term Loan Facility and the loans thereunder the Term Loans in an aggregate principal amount of. Unlike a traditional term loan that is provided in a. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term.

Means in respect of the Delayed Draw Term Facility a percentage per annum equal to. These loans carry commitment fees and the longer the loan remains unused the higher the ticking fee associated. Low Fixed APR from 399.

1 In respect of any Delayed Draw Term Loan. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed. Define Delayed Draw Term Commitment Fee Percentage.

That is the fees are paid. Means a with respect to each Delayed Draw Term Loan Lender for the period from and including the Closing Date to but excluding. A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount.

Delayed draw term loans are a flexible way for borrowers.

Financing Fees What Are Financing Fees In M A

Corporate Banking Sell Side Handbook

Columbia Sipa Center On Global Energy Policy Comparing Government Financing Of Reactor Exports Considerations For Us Policy Makers

Pandemic Leads Lenders To Tighten Rules On Delayed Draw Term Loans S P Global Market Intelligence

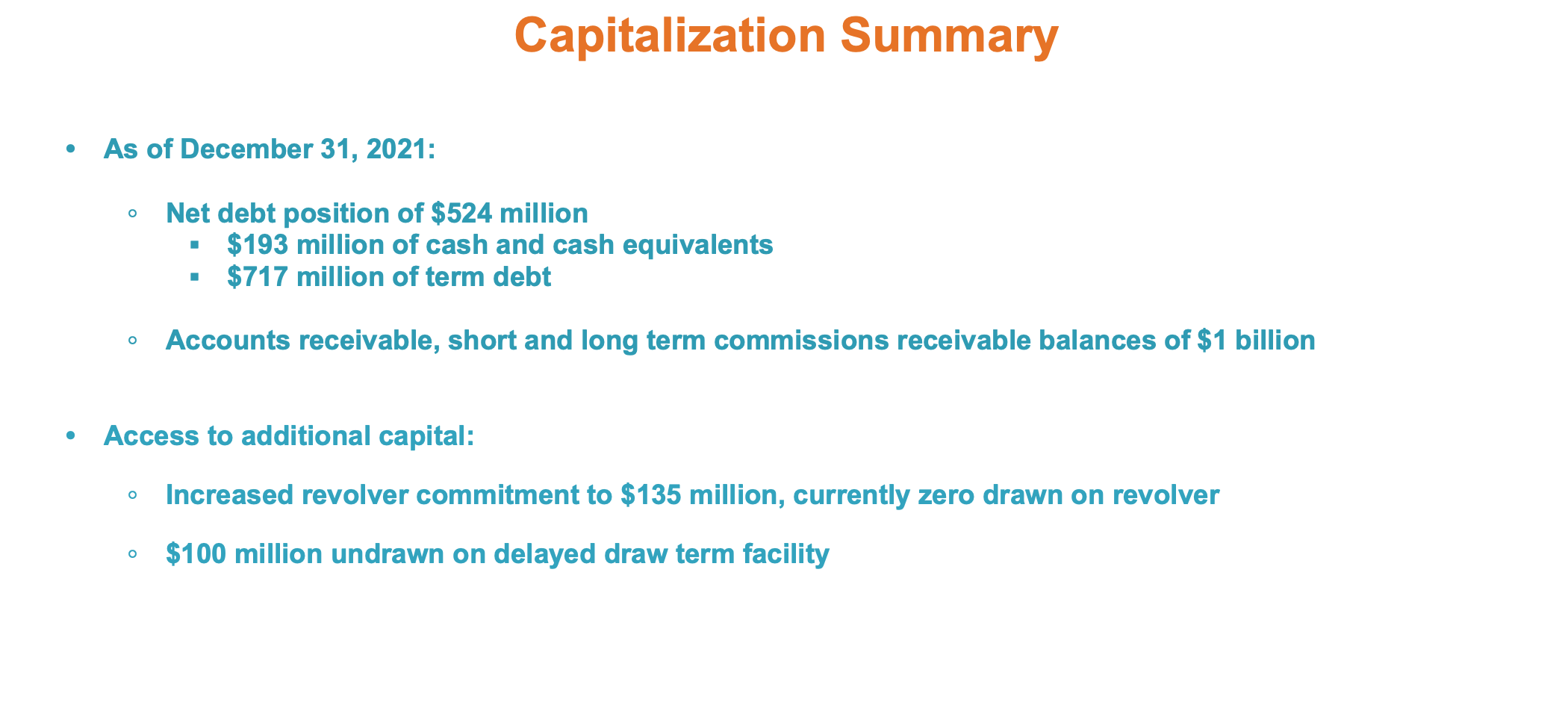

Selectquote Stock This Did Not Turn Out As Planned Nyse Slqt Seeking Alpha

Horizon Global Corporation 2021 Ar

![]()

Investment Accounting Software Systems Allvue Systems

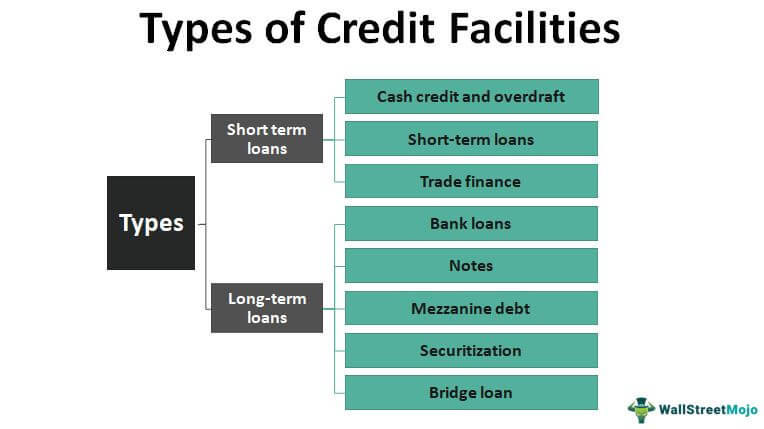

Types Of Credit Facilities Short Term And Long Term

The Total Cost Of Corporate Borrowing In The Loan Market Don T Ignore The Fees Berg 2016 The Journal Of Finance Wiley Online Library

Leveraged Loan Primer Pitchbook

7 3 Classification Of Preferred Stock

Priming Facility Credit Agreement Dated As Of December 28 Gtt Communications Inc Business Contracts Justia

Deerpath Capital Management Lp

Learn About Commitment Fees Chegg Com